Benefits of Procure-to-Pay Software

As the Covid-19 crisis intensifies, more and more organisations are looking to work from home in the long run, and if we look at the broader picture, Covid-19 may prove to be a major tipping point for workplace digitisation. The entire supply chain industry, and departments dealing in the procurement of raw materials have taken a significant hit as well. On March 30th, Gartner surveyed 317 CFOs and business finance leaders and found that 74% of those surveyed expect at least 5% of their workforce will become permanent work-from-home employees after the pandemic ends. TCS, on the other hand, mentioned that their goal is to shift 75% of their staff to work from home by 2025. The impact is likely to be both severe and protracted.There is a need for the industry to adapt with the changing times, adopting the best practices necessary for making the purchase process more streamlined and saving on costs.

A typical procure to pay process starts with planning the requirement, requesting for quotation, followed by selecting the vendor with the best prices, creating the purchase order and the goods receipt, assessing the orders received and performing quality checks followed by the payment invoice to complete the purchase process.

The basic Procure to Pay cycle consist of the following:

Purchase Requisition

Requests for the procurement of the requirement of commodities, products or services needed gets approved by the management and goes to the procurement team.

Purchase Orders

The procurement team selects the best suppliers from their database, goes through multiple emails and conducts numerous phone calls and creates purchase orders. Due to dispersed supplier information, it takes a lot of time for the procurement teams to close an order.

Receipt of Goods

After the order is complete, the supplier sends the invoice to all the respective departments, and the purchase team manually uploads it when the shipment arrives. The task is often cumbersome and time-consuming.

Invoicing

After the shipment is confirmed, the invoice receipt is sent to the seller. Organisations using non-P2P methods of invoicing still send the invoice via email or fax. The invoice is then matched against the PO.

Invoice Approval

After the invoice is checked, the receipt is the ERP software. The process is stacked with multiple ERPs and checks of authorisation.

Payment

Lastly, when the ERP integration is done, the payment is made. Often, payments are made without internal approvals, or are duplicated. Not having a solution to track spends leads to unnecessary losses, paying ad-hoc is inefficient, takes longer and usually allows cash, which is not the best practice to follow as it ultimately creates a system with a lack of transparency.

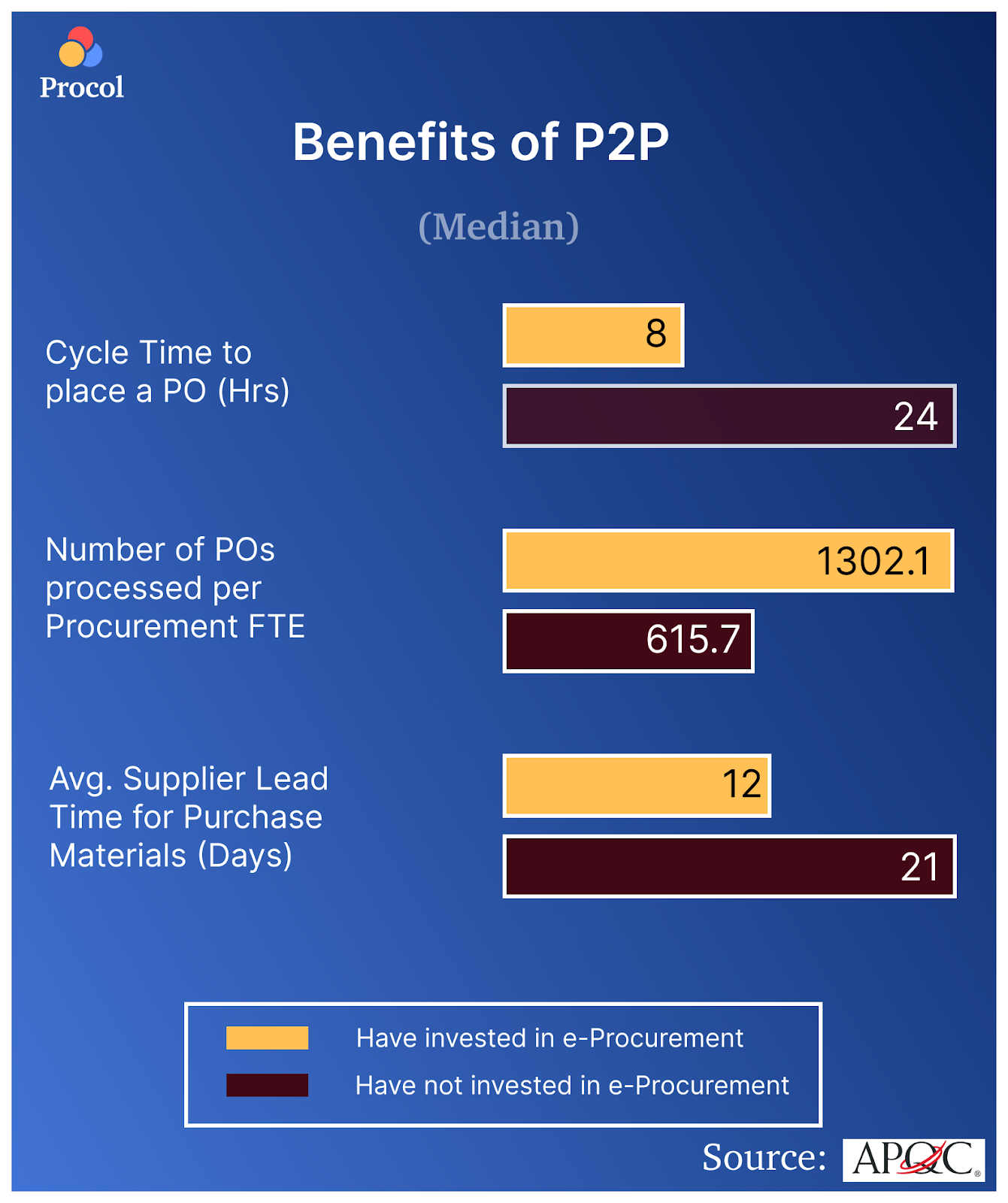

There is a need for organisations to move from traditional legacy systems of work to new cloud-based processes which unify Procure to Pay (P2P) solutions. Digital Procure to Pay solutions bring all the purchase processes under a single, easy-to-use platform. According to the American Productivity and Quality Center (APQC)’s Open Standards Benchmarking, automation processes help companies create 1302.1 purchase orders, as opposed to 615.7 purchase orders per full-time employee (FTE), while the median cycle time to place a purchase order is reduced from 24 hours to 8 hours.

Automating the entire procurement cycle provides a plethora of benefits for the procurement teams. Here are some of the benefits you get from digital Procure to Pay solutions:

- Reducing Costs and Direct Spends

Automated P2P Solutions provide the ability to breakout and analyse spend across different buying categories while ensuring that budgets and savings are tracked regularly. Purchasing can be controlled using automated approvals and thresholds for specified amounts. With a digital P2P system, companies can see early payment missed opportunities and bulk order discounts to point out the possibility of better negotiations and the opportunity for savings.

- Improving workflow automation

It is estimated that even though 41% companies are pairing their accounting or ERP system with eProcurement tools, only 20% of businesses use a cloud-based eProcurement solution. Using an automated P2P system, invoices can be put straight through to the organisation’s ERP for payment. Automating such processes reduces both time and cost, enabling employees to focus on more strategic initiatives instead of working on repetitive tasks. Automated P2P systems allow purchase requisitions to get approved faster, and sent to the suppliers seamlessly.

- Gaining insights through spend analysis

Eliminate the requirement for paperwork and enforces manual checks within each stage of the procure to pay process, real-time strategic data allows purchase departments gain better visibility, generate deeper insights into the supply base, and unlock saving opportunities. A Procure to pay solution can also provide end to end visibility between POs, goods receipts, invoices, and other documents to ensure goods are as per specification before issuing payment.

- Digitising Contract Management

Often, organisations dealing with a particular commodity, prefer existing suppliers from which generally source the goods. However, it is difficult to access the past offerings of suppliers from thousands of stacks. Automated procure to pay offerings like Procol, can help purchase managers generate a digital repository in order to store vendor contracts allowing them to easily get a track of their previous order history from any supplier at the time of purchase.

- Enhancing vendor collaboration

Without any digital repository source, buyers would often have to contact each of their suppliers individually, with more and more companies looking to expand their vendor base, it is imperative for them to enhance vendor collaboration. Using an automated P2P solution would ensure that both buyers and suppliers can obtain real-time data in order to make accurate and informed decisions. Having an end-to-end visibility regarding the purchase orders, invoices and other receipts will ensure that buyers and vendors are working synergically. Through the supplier portal, suppliers can have clear visibility about their payment status in order to plan for the future.

For procurement teams, the major reason for risk exposure is due to inefficiencies of the manual process, and the bottlenecks associated with it. The benefits of Procure to Pay Software are derived from end-to-end integration of the entire procurement cycle. Spend Analysis, for example, requires complete visibility. A Procure-to-pay software can collate all the transactional data in a single, secure location for one-click analysis, requiring approval before the order is sent to the vendor. Automated on-boarding of new vendors, along with measuring their effectiveness based on their price and negotiation history can significantly streamline the supply chain while ensuring that a risk mitigation strategy is in place. Choosing the procurement system which fits your business requires the understanding of the specific company needs and the ways in which a cloud-based P2P solution like Procol can help you meet them.

About This Topic

This is the default description of the category uncategorized

Explore More from Procol

Discover expert tips, how-to guides, industry insights, and the latest procurement trends.

Top Auction Software for Procurement in 2024

Introduction Auction software has become essential for procurement specialists and enterprises....

Why is Contract Management Software Essential for Businesses?

In today’s fast-paced business world, good contract management has become essential...

Contract Lifecycle Management Software: Essential for Business Success

Effective CLM software is crucial in today’s business world. It streamlines...